And since some SDIRAs such as self-directed standard IRAs are topic to needed minimum amount distributions (RMDs), you’ll should strategy forward to make certain you've sufficient liquidity to meet the rules set through the IRS.

An SDIRA custodian is different because they have the suitable team, knowledge, and capability to keep up custody of the alternative investments. Step one in opening a self-directed IRA is to locate a service provider that is certainly specialised in administering accounts for alternative investments.

Housing is one of the most popular options among the SDIRA holders. That’s mainly because you may invest in any sort of real-estate using a self-directed IRA.

Research: It is called "self-directed" for just a explanation. With the SDIRA, that you are totally accountable for comprehensively exploring and vetting investments.

No, You can not put money into your very own organization using a self-directed IRA. The IRS prohibits any transactions in between your IRA plus your individual organization because you, since the proprietor, are deemed a disqualified individual.

Confined Liquidity: A lot of the alternative assets that could be held within an SDIRA, for instance real-estate, non-public fairness, or precious metals, might not be conveniently liquidated. This may be a concern if you must accessibility resources immediately.

Criminals from time to time prey on SDIRA holders; encouraging them to open accounts for the objective of making fraudulent investments. They typically idiot investors by telling them that If your investment is accepted by a self-directed IRA custodian, it need to be respectable, which isn’t genuine. Yet again, Be sure to do extensive homework on all investments you choose.

Consumer Help: Seek out a company that gives focused assistance, like access to proficient specialists who can response questions on compliance and IRS principles.

Entrust can support you in getting alternative investments with the retirement cash, and administer the getting and promoting of assets that are typically unavailable as a result of financial institutions and brokerage firms.

In advance of opening an SDIRA, it’s important to weigh the prospective advantages and drawbacks dependant on your unique economical plans and hazard tolerance.

Have the liberty to speculate in Virtually any type of asset by using a possibility profile that fits your investment approach; together with assets which have the prospective for an increased fee of return.

Place only, in case you’re hunting for a tax productive way to create a portfolio that’s much more tailored for your pursuits and abilities, an SDIRA can be The solution.

As an Trader, nonetheless, your choices will not be restricted to shares and bonds if you choose to self-immediate your retirement accounts. That’s why an SDIRA can change your portfolio.

Numerous investors are shocked to know that applying retirement cash to take a position in alternative assets is achievable considering that 1974. Even so, most brokerage firms and banking institutions deal with providing publicly traded securities, like stocks and bonds, mainly because they lack the infrastructure and expertise to control privately held assets, including real-estate or non-public fairness.

Producing one her latest blog of the most of tax-advantaged accounts allows you to hold extra of the money which you spend and get paid. Dependant upon no matter whether you select a conventional self-directed IRA or even a self-directed Roth IRA, you've the probable for tax-free or tax-deferred progress, furnished sure conditions are achieved.

IRAs held at banking institutions and brokerage firms supply constrained investment options for their customers given that they would not have the experience or infrastructure click over here now to administer alternative assets.

Even though there are many Added benefits linked to an SDIRA, it’s not with out its individual drawbacks. Several of the common explanations why traders don’t pick out SDIRAs contain:

SDIRAs in many cases are used by arms-on investors who are ready to take on the risks and responsibilities of selecting and vetting their investments. Self directed IRA accounts can even be perfect for investors who may have specialized expertise in a distinct segment sector that they want to put money into.

Choice of Investment Alternatives: Make sure the supplier allows the categories of alternative investments you’re thinking about, for instance property, precious metals, or non-public equity.

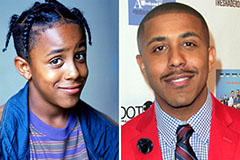

Marques Houston Then & Now!

Marques Houston Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!